In today’s fast-paced and uncertain economic landscape, achieving financial success is no longer just about earning more; it’s about making smarter financial decisions. For Ugandans, the journey to financial freedom comes with unique opportunities and challenges—from leveraging mobile money to navigating a growing entrepreneurial ecosystem.

The good news? Regardless of where you are on your financial journey, it’s possible to secure your future and achieve lasting stability. The key lies in adopting effective strategies that align with your goals and Uganda’s dynamic economic realities. Here are ten actionable tips to get you started.

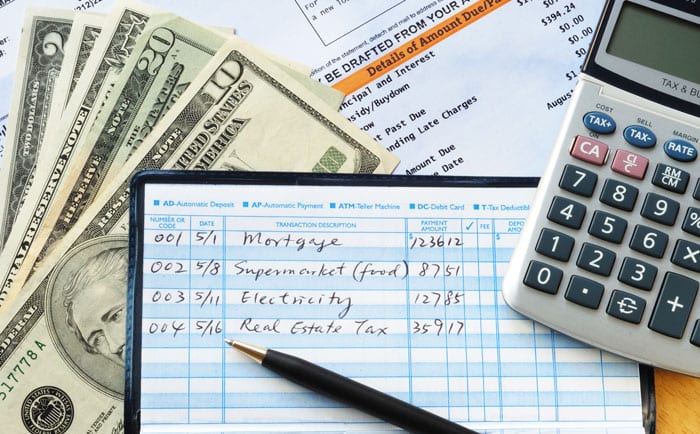

1. Create a Budget and Stick to It

The foundation of financial success is a solid budget. A well-crafted budget helps you track your income, control expenses, and allocate funds for savings and investments.

Start by listing your income sources and categorizing expenses into needs (like food, rent, and transport) and wants (like entertainment). Tools like budgeting apps or a simple Excel sheet can make tracking your finances easier. Once your budget is set, stick to it religiously to avoid unnecessary spending.

- Save Consistently

Consistency in saving is what transforms small amounts into significant financial security. Even if you start with as little as 10% of your income, saving regularly builds discipline and a financial safety net for emergencies or investments.

Automate your savings using mobile banking platforms like MTN MoMo or Airtel Money, so you’re not tempted to spend before saving.

3. Avoid Unnecessary Debt

Debt can be a double-edged sword. While loans can help fund a business or pay for education, unnecessary borrowing—especially for luxury items—can derail your financial progress.

Always evaluate the purpose of taking a loan and ensure the repayment terms are within your capacity. Focus on high-value debt that can generate returns, such as a business loan, and steer clear of consumer debt.

4. Invest Wisely to Grow Your Wealth

Investing is a crucial step in building long-term wealth. Uganda offers numerous opportunities, including agriculture, real estate, and the stock market. SACCOs (Savings and Credit Cooperative Organizations) are another excellent way to pool resources and earn dividends.

Start small, diversify your portfolio, and seek professional advice before committing to any significant investments.

5. Build a High-Income Skill

The job market is competitive, and relying on one income stream is no longer enough. High-income skills such as graphic design, web development, digital marketing, or copywriting can significantly increase your earning potential.

Leverage platforms like Coursera, Udemy, or even YouTube to learn these skills. Once mastered, use them to create additional revenue streams.

6. Plan for Emergencies

Life’s unpredictability makes an emergency fund a necessity. Aim to save at least 3-6 months’ worth of living expenses to cover unforeseen situations like medical emergencies or job loss.

Store these funds in a separate, easily accessible account to ensure they’re used strictly for emergencies.

7. Understand and Comply with Taxes

Tax compliance isn’t just about avoiding penalties; it’s also a critical aspect of financial planning. Register for a Tax Identification Number (TIN) if you’re self-employed or running a business. Familiarize yourself with Uganda Revenue Authority (URA) tax requirements, such as Pay-As-You-Earn (PAYE) and Value Added Tax (VAT).

Keeping accurate financial records simplifies tax filing and ensures you stay on the right side of the law.

8. Network and Seek Mentorship

Success often comes through connections and shared knowledge. Attend networking events, business expos, and forums to meet professionals and mentors who can guide you on your financial journey.

A strong network can open doors to new opportunities, collaborations, and practical advice tailored to your specific goals.

9. Start a Side Hustle

Uganda’s growing entrepreneurial spirit offers countless opportunities for side hustles. Whether it’s selling crafts, offering freelance services, or starting an online store, an additional income stream strengthens your financial base.

Identify your skills or interests, assess market demand, and start small to test the waters.

10. Plan for Retirement Early

Retirement planning is often overlooked but essential for long-term security. Contribute to the National Social Security Fund (NSSF) if you’re employed, or set up a personal retirement savings plan.

Investing in passive income sources, such as rental properties or dividend-paying stocks, ensures a steady cash flow during retirement. Starting early gives your savings more time to grow, thanks to the power of compound interest.

Take Control of Your Financial Future Today

Building financial success isn’t reserved for a select few; it’s attainable for anyone willing to make informed decisions and take deliberate actions. Whether you’re just starting to manage your money or looking for ways to grow your wealth, there’s no better time than now to start.

Create a budget that works for your lifestyle. Automate your savings. Invest wisely in opportunities like real estate or agriculture. And most importantly, ensure every decision you make aligns with your long-term goals.

The road to financial freedom requires consistency and discipline, but the rewards are life-changing. Your financial success story starts with a single step—so take it today. Set a goal, act with purpose, and secure the financial future you deserve.

With these actionable tips, the path to financial success in Uganda becomes clear. Start small, stay consistent, and watch your financial future transform.