Retirement planning is an essential aspect of financial management that often gets overlooked, especially in developing countries like Uganda. With the increasing cost of living, evolving social dynamics, and the need for financial security in old age, it is crucial for individuals to take proactive steps to ensure a comfortable retirement. This comprehensive guide will explore various strategies and options available for planning your retirement in Uganda, empowering you to create a secure financial future.

Steps to Plan for Retirement in Uganda

1. Start Early and Save Consistently

The earlier you start saving for retirement, the better your financial situation will be when you retire. Here are some strategies to help you save consistently:

Set a Savings Goal: Determine how much you need for retirement and set a monthly savings target. Consider factors like lifestyle, healthcare, and inflation.

Automate Your Savings: Set up automatic transfers from your checking account to your retirement account to ensure you save consistently without having to think about it.

Review and Adjust: Periodically review your savings plan and adjust your contributions based on changes in income or expenses.

2. Utilize Retirement Benefit Schemes

Uganda has over 60 retirement benefit schemes regulated by the Uganda Retirement Benefits Regulatory Authority (URBRA). These schemes offer various options for saving and investing for retirement, such as:

Pension Funds: These longterm savings plans provide retirement income based on contributions and fund performance.

Provident Funds: These funds allow you to withdraw your savings as a lump sum upon retirement, giving you flexibility in how you use your funds.

Umbrella Schemes: Designed for small and medium enterprises, these schemes allow multiple employers to pool their employees’ contributions into a single fund.

3. Take Advantage of Social Security and Government Pension Schemes

If you are employed in the private sector or an NGO, you are entitled to contribute to the National Social Security Fund (NSSF). Your employer must also make a 10% contribution each month. Government employees benefit from a public pension scheme, which does not require personal contributions. Understanding these benefits can significantly boost your retirement savings.

4. Diversify Your Investments

Diversifying your investments is essential to mitigate risks and potentially increase your returns over time. Here are some investment options to consider:

Real Estate: Investing in rental properties can provide a steady income stream during retirement. Look for properties in growing neighborhoods or urban areas.

Stocks and Bonds: Consider investing in the stock market or government bonds to grow your wealth over time. Explore local and regional stock exchanges for opportunities.

Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio, providing a balanced approach to investment.

Agricultural Investments: Given Uganda’s agricultural economy, consider investing in agricultural ventures or cooperatives that can yield returns while supporting local communities.

5. Seek Professional Advice

Consulting with a financial advisor can be invaluable in developing a personalized retirement plan. A professional can help you assess your current financial situation and provide guidance on:

Investment Options: Identifying the best investment vehicles for your goals and risk tolerance.

Tax Implications: Understanding how taxes will affect your retirement savings and income.

Retirement Strategies: Creating a comprehensive plan that aligns with your retirement goals, including legacy planning for your family.

6. Plan for Healthcare Costs

As you age, healthcare expenses are likely to increase. It’s essential to factor in these costs when planning for retirement. Here are some steps to prepare:

Health Insurance: Consider investing in a health insurance plan that covers your medical needs in retirement. Look for policies that offer comprehensive coverage, including outpatient and inpatient services.

Health Savings Account: If available, contribute to a health savings account (HSA) to save for medical expenses taxfree. This can help alleviate the financial burden of healthcare in retirement.

7. Reduce Debt and Manage Expenses

Aim to pay off debts, such as mortgages and loans, before retiring. This will free up funds for other expenses and reduce financial stress in retirement. Here are some strategies to manage your debt:

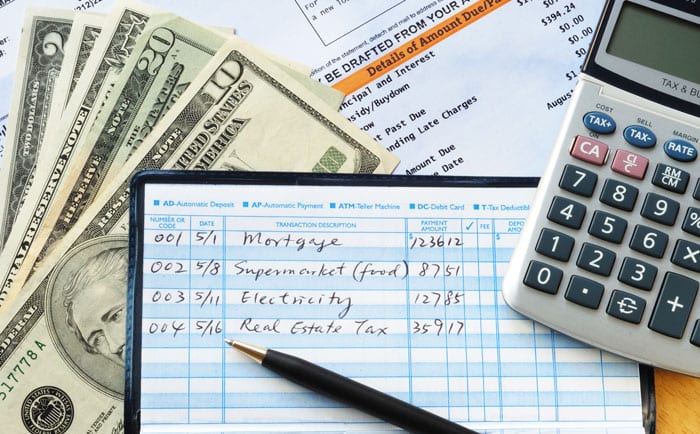

Create a Budget: Track your income and expenses to identify areas where you can cut back. Use budgeting apps or spreadsheets to monitor your financial health.

Prioritize Debt Repayment: Focus on paying off highinterest debts first to reduce your overall financial burden. Consider consolidating loans to lower interest rates.

8. Consider Annuities and Drawdown Options

When you retire, you can choose between an annuity or an income drawdown option. Understanding these options can help you make an informed decision:

Annuities: These provide a guaranteed monthly income for life, offering financial security in retirement. Research different types of annuities to find one that suits your needs.

Income Drawdown: This option allows you to manage your portfolio and withdraw funds periodically, giving you more control over your retirement income. Be mindful of your withdrawal rate to ensure your savings last.

Conclusion

Planning for retirement in Uganda requires a proactive approach and a longterm commitment. By starting early, saving consistently, and taking advantage of the available retirement planning tools, you can work towards a secure and comfortable retirement. Remember, the key is to seek professional guidance, diversify your investments, and manage your expenses effectively.

Don’t wait until it’s too late! Start planning for your retirement today by contacting a financial advisor or visiting the Uganda Retirement Benefits Regulatory Authority website to learn more about the available retirement benefit schemes. Engage with local community financial workshops or online resources to enhance your knowledge. Your future self will thank you for taking the necessary steps to secure a comfortable and financially stable retirement. Take action now—your golden years are worth it!