The perfect retirement in Uganda will look different for everyone, but what people do have in common is the need to have some sort of plan in place. It’s never too early or too late to think about your life after you finish working.

Retiring early in Uganda, like in many other countries, requires careful planning, disciplined saving, and smart investing. Here are some tips to help you achieve early retirement:

Set Clear Goals: know when you start retirement planning

When should you start retirement planning? That’s up to you, but the earlier you start planning, the more time your money has to grow. Determine the age you want to retire and estimate how much money you’ll need annually to sustain your lifestyle in retirement. Consider inflation, healthcare costs, and potential lifestyle changes.

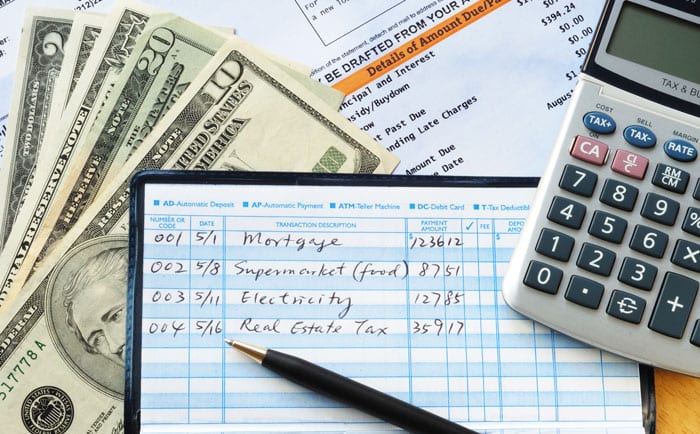

Create a Budget and Save Aggressively

Develop a strict budget that prioritizes savings and investment. Aim to save a significant portion of your income, ideally 20-50%, depending on your financial goals.

Invest Wisely

Diversify your investments to balance risk and returns. Consider a mix of stocks, bonds, real estate, and other assets.

Invest in rental properties or land, as real estate can provide a steady income stream and appreciate over time.

Consider areas with potential for growth and demand for rental properties.

Start a Side Business

Consider starting a side business or freelance work to generate additional income.

Use the extra earnings to boost your savings and investments.

Reduce Debt

Prioritize paying off high-interest debt, such as credit cards and personal loans, Avoid accumulating new debt unless it’s strategically planned, like a mortgage for investment property.

Plan for Healthcare

Consider health insurance plans or savings accounts specifically for medical expenses.

Factor healthcare costs into your retirement budget.

Retirement Accounts

Explore local options for retirement savings accounts, such as provident funds or other retirement benefit schemes offered by employers or financial institutions like the NSSF.

Continuous Learning

Stay informed about financial markets, investment opportunities, and retirement planning strategies.

Consider financial education courses or seminars.

Consult a Financial Advisor

Ask for advice if you need it, Ugandan wallet offers access to a range of financial advice and support to help you plan your retirement, Regularly review and adjust your plan as needed to stay on track.

Conclusion

Early retirement in Uganda is achievable with careful planning, discipline, and a strategic approach. By understanding your financial situation, building a substantial retirement fund, reducing expenses, planning for healthcare, and leveraging your skills and experience, you can create a fulfilling and financially secure retirement. Remember, the journey to early retirement is a marathon, not a sprint. Stay focused, be patient, and enjoy the process.

By implementing these strategies, you can work towards achieving financial independence and retiring early in Uganda.