Starting to save money in Uganda can be a straightforward process if you approach it with discipline and clear goals. Here’s a step-by-step guide to help you get started:

Saving money in Uganda is an essential financial habit that can help you achieve both short-term goals and long-term financial security. In Uganda, where many individuals face economic uncertainties and rising living costs, building a savings culture is more important than ever. Whether you’re saving for an emergency fund, a major purchase, or future investments, understanding how to start saving is the first step towards financial independence. In this guide, we’ll walk you through practical strategies for saving money in Uganda, from budgeting tips to choosing the right savings accounts, all tailored to suit the local context and economic landscape.

1.Set Clear Savings Goals

Setting clear savings goals is a crucial step in developing a strong saving habit. In Uganda, having well-defined goals can motivate you to stay consistent and disciplined, regardless of your income level. Here’s how you can set effective savings goals:

Identify Your Purpose: Start by identifying why you want to save. Whether it’s for an emergency fund, buying land, paying school fees, or investing in a business, having a clear purpose will guide your savings journey.

Set SMART Goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to save money,” set a goal like “I will save UGX 1 million by the end of the year to purchase land.”

Break Down the Goal: Once you have your overall target, break it down into manageable amounts. If you plan to save UGX 1 million in 12 months, that means saving around UGX 83,000 per month.

Prioritize Your Goals: In Uganda, there may be competing demands on your finances. Prioritize your savings goals based on urgency and importance, and focus on those that align with your long-term financial aspirations.

Track Your Progress: Keep track of your savings progress regularly to stay motivated. You can use mobile apps, savings accounts, or simple budgeting tools to monitor how close you are to reaching your goal.

Having specific goals can motivate you to save consistently and help you determine how much you need to save and how long it will take.

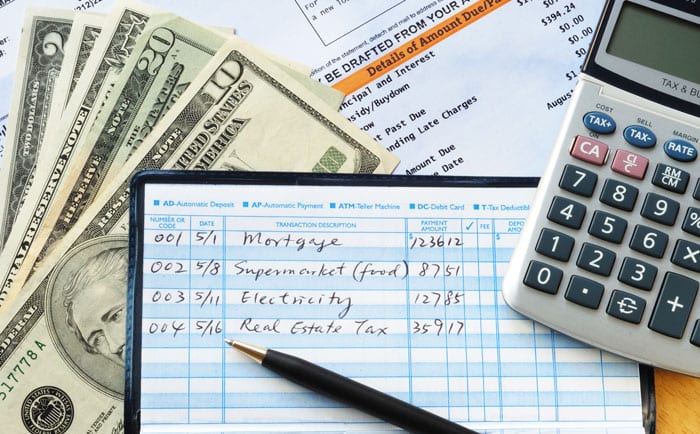

Step 2: Create a Budget

Creating a budget is a fundamental step in managing your finances and ensuring you can save effectively. In Uganda, where incomes can fluctuate and unexpected expenses are common, having a well-structured budget can help you stay on track. Here’s how you can create a practical budget:

List Your Income Sources: Start by identifying all sources of income. This can include your salary, business profits, freelance work, or any other earnings. It’s important to calculate your average monthly income, especially if your income varies.

Track Your Expenses: Identify your regular expenses, such as rent, utilities, food, transportation, school fees, and any loan repayments. Categorize them into fixed (those that remain the same each month, like rent) and variable expenses (those that change, like groceries or fuel).

Prioritize Your Needs: In Uganda, prioritizing essential expenses such as food, shelter, and transport is critical. Make sure these needs are fully covered before allocating money to less critical areas, like entertainment or luxury items.

Set Aside Savings: Decide on a percentage or specific amount of your income that will go toward savings. You can use the “pay yourself first” approach by setting aside savings before spending on other things. A common recommendation is to save at least 10-20% of your income.

Track and Adjust: After implementing your budget, track your spending regularly to see how well you’re sticking to it. Review and adjust your budget monthly based on changes in your income or expenses, and make sure you’re not overspending in any category.

A budget will help you manage your finances effectively and ensure you allocate money for savings.

Step 3: Open a Savings Account

Opening a savings account in Uganda offers several important benefits that can help you achieve your financial goals while providing security and growth for your money. Here’s why opening a savings account is crucial:

Choose a Reputable Bank: Select a bank or financial institution with good interest rates and low fees.

Consider Mobile Money Savings Accounts: Services like MTN Mobile Money or Airtel Money offer savings accounts with interest, making it convenient to save from your mobile phone.

Security for Your Money: A savings account provides a safe place to store your money, protecting it from theft or loss. In Uganda, where many people still keep money at home or in informal savings groups, a savings account ensures your funds are protected by a regulated financial institution.

Interest Earnings: Unlike keeping cash at home, a savings account allows you to earn interest on your deposited funds. Although interest rates vary depending on the bank, this growth helps you reach your savings goals faster while your money works for you.

Access to Financial Services: With a savings account, you gain access to other important financial services like mobile banking, loans, and investment opportunities. This can open doors to grow your wealth or expand your business in the future.

Encourages Consistent Savings: Having a savings account creates a structure that encourages disciplined saving. With many banks offering automatic savings plans or regular account updates, you can keep track of your progress and stay motivated to save regularly.

Emergency Fund: A savings account acts as a financial cushion in case of emergencies. With quick access to your funds when needed, you can cover unexpected expenses such as medical bills or urgent repairs without relying on loans or high-interest credit.

Having a dedicated savings account helps separate your savings from your spending money and can earn you interest over time.

Step 4: Automate Your Savings

Automating your savings is one of the most effective strategies for consistently building wealth, especially in Uganda, where financial discipline can be challenging amidst daily expenses. By setting up automated savings, you ensure that a portion of your income is saved before you even have the chance to spend it. Here’s how automating savings can help:

Consistency in Saving: Automating your savings guarantees that you set aside money regularly, whether it’s weekly, monthly, or whenever you receive income. This consistency ensures that your savings grow steadily over time without relying on willpower or manual effort.

Eliminates the Temptation to Spend: When savings are automated, the funds are deducted before you can access or spend them. This minimizes the temptation to use money for non-essential purchases, helping you stay on track with your financial goals.

Customizable Savings Plans: Many banks in Uganda offer automatic transfer services, allowing you to set up regular transfers from your current account to your savings account. You can tailor this to suit your income schedule, ensuring that your savings grow effortlessly.

Builds Discipline and Financial Security: Automated savings installl financial discipline and can help you build a solid emergency fund or save for larger financial goals like buying land, investing in a business, or paying school fees.

- Set Up Automatic Transfers: Arrange for a fixed amount of money to be automatically transferred from your checking account to your savings account each month.

- Use Mobile Money: Set up automatic transfers to your mobile money savings account if you prefer managing your finances digitally.

By automating your savings, you not only streamline the process but also make sure you’re consistently working toward financial independence in a way that requires minimal effort.

Step 5: Start Small and Increase Gradually

Starting small and increasing gradually is a practical and achievable approach to saving in Uganda, especially for individuals with limited income or financial obligations. Here’s why this saving tip is essential:

Builds a Habit: Saving can feel daunting when you aim for big amounts right away. By starting with small, manageable amounts, you develop the habit of saving regularly. Even if you begin with UGX 5,000 a week, it’s the consistency that counts, not the amount.

Reduces Financial Pressure: When you start small, it’s easier to fit saving into your budget without feeling financially stretched. In Uganda, where daily expenses can be unpredictable, saving small amounts ensures you don’t compromise your basic needs.

Grows Over Time: As your financial situation improves or your income increases, you can gradually increase the amount you save. For instance, once you’re comfortable saving UGX 5,000 a week, you can move up to UGX 10,000 or more over time, allowing your savings to grow steadily.

Psychological Boost: Seeing your savings increase, even if you start small, can provide a motivational boost. It reinforces the idea that you’re making progress toward your financial goals, no matter how modest the beginning.

Starting small makes it easier to build the habit of saving, and gradually increasing the amount helps you grow your savings faster.

Step 6: Reduce Debt

Reducing debt is a crucial step towards improving your financial health and boosting your savings in Uganda. Carrying high levels of debt can make it challenging to save, as a significant portion of your income goes toward loan repayments. Here’s why reducing debt is important for saving:

Free Up More Income for Savings: When you reduce or eliminate debt, you free up more of your income, which can then be directed towards savings. In Uganda, many people take out loans for things like school fees or small businesses, but paying off these debts early gives you more breathing room to save.

Avoid High Interest Payments: High-interest loans, such as those from money lenders or mobile loan apps, can quickly eat into your finances. By prioritizing debt reduction, especially on high-interest debt, you minimize the amount you spend on interest, allowing you to keep more of your money.

Improve Financial Stability: Reducing debt lowers financial stress and improves overall stability. In Uganda, having fewer debts allows you to better manage unexpected expenses, emergencies, and other financial obligations, making it easier to maintain consistent savings.

Focus on Long-term Goals: Once you’ve reduced your debt, it’s easier to focus on long-term savings goals like buying land, investing in education, or starting a business. With less debt hanging over you, you can dedicate more of your resources to achieving these goals.

By focusing on reducing your debt, you create more room in your budget for savings, helping you achieve financial independence and security in the long run.

Step 7: Monitor and Adjust Your Savings Plan

Monitoring and adjusting your savings plan is a key strategy for ensuring that you stay on track with your financial goals in Uganda. Life circumstances, expenses, and income levels can change, making it important to regularly evaluate your savings strategy. Here’s why this tip is essential:

Adapts to Changing Circumstances: In Uganda, economic conditions or personal situations, like changes in income or unexpected expenses, can affect your ability to save. By monitoring your savings plan, you can adjust your contributions to reflect your current financial reality while still working toward your goals.

Helps You Stay on Track: Regularly reviewing your savings progress helps you see how close you are to achieving your financial targets. If you notice that you’re falling behind, you can make adjustments, such as cutting unnecessary expenses or finding ways to increase your income.

Maximizes Opportunities: Monitoring your savings plan allows you to take advantage of new opportunities, like higher interest savings accounts or investment options that could accelerate your financial growth. By adjusting your strategy, you ensure that you are making the most of available financial tools in Uganda.

Improves Financial Discipline: When you track your savings plan regularly, it reinforces financial discipline. You become more conscious of your spending and saving habits, making it easier to prioritize your financial goals and avoid unnecessary expenses.

By monitoring and adjusting your savings plan, you ensure that it remains relevant and effective in helping you reach your financial goals, no matter how your situation evolves over time.

Conclusion

Saving money in Uganda may come with challenges, but with the right strategies, it is entirely achievable. By setting clear goals, creating a budget, reducing debt, automating your savings, and regularly monitoring your progress, you can build a solid financial foundation for the future. Whether you’re saving for an emergency fund, a business investment, or long-term financial security, the key is to start small, stay consistent, and adapt as needed.

Now that you’ve learned how to save money effectively in Uganda, it’s time to take the first step. Begin by setting up a savings goal today, open a savings account, and commit to a plan that works for you. Remember, the sooner you start, the closer you’ll get to achieving your financial dreams! If you’re ready to improve your financial journey, subscribe to our blog for more tips and insights on personal finance in Uganda.