Sometimes Saving money on a low income can seem like an impossible task, especially when the cost of living continues to rise. However, with the right strategies, even those earning modest wages in Uganda can start building up savings. It’s not always about how much you make, but how well you manage what you have. This step-by-step guide can help you develop a simple and realistic strategy, so that you can save for all your short- and long-term goals.

1. Create a Budget

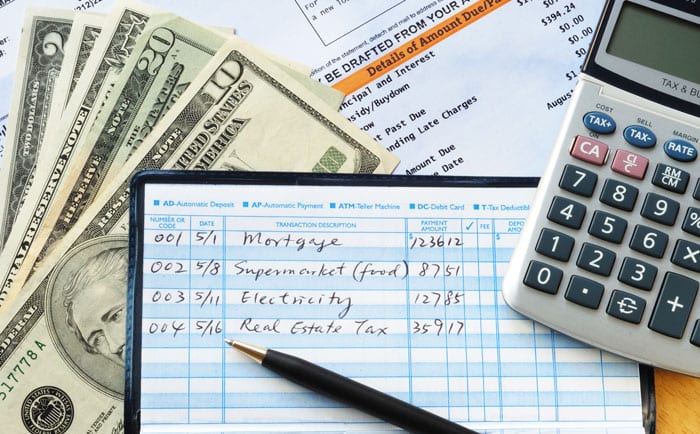

The foundation of any savings plan is a budget. By tracking where every shilling goes, you can identify unnecessary expenses and find areas to cut back. A budget will help you prioritize essentials like food, rent, and transport while highlighting areas where you can save, such as entertainment or dining out. There are several budgeting apps and tools like Microsoft Excel that can make this process easier.

2. Set Clear Realstic Saving Goals

Having a specific goal to work toward, such as saving for school fees, an emergency fund, or a small business, can motivate you to stick to your savings plan. Start by setting small, achievable goals and gradually increase them as you get more comfortable with saving. For instance, aim to save UGX 5,000 per week, then increase the amount as your income grows or you reduce expenses.

3. Automate Your Savings

One of the easiest ways to save is by automating the process. If you receive your salary through a bank account or mobile money, set up an automatic transfer to a savings account. This way, you don’t have to manually transfer money each time you get paid, and you’ll be less tempted to spend it. Several banks in Uganda, like Centenary Bank and Stanbic Bank, offer automated savings options.

4. Avoid Impulse Purchases

Impulse buying is one of the biggest barriers to saving money. Whether it’s buying snacks, new clothes, or gadgets you didn’t plan for, these small purchases can add up quickly. To combat impulse buying, always create a shopping list before you leave the house and stick to it. If you feel the urge to buy something on a whim, wait 24 hours to see if you still want it.

5. Take Advantage of Discounts and Offers

Always be on the lookout for discounts and special promotions. Whether it’s at the supermarket, on mobile money services, or from utility providers, small savings add up over time. Shop at local markets where prices can be negotiated and buy in bulk when possible to save on household items. Additionally, take advantage of loyalty programs offered by supermarkets and fuel stations.

6. Cut Back on Utility Bills

Utility bills, such as electricity and water, are necessary expenses but can often be reduced. Switch off lights and electrical appliances when not in use, fix leaking taps, and use energy-saving bulbs to reduce your electricity costs. Additionally, consider solar-powered appliances, which can greatly reduce your electricity bills in the long run.

7. Cook at Home

Eating out is often more expensive than preparing meals at home. By cooking your meals, you have more control over the ingredients and portions, which can help you save money. Buy food in bulk and store it properly to avoid wastage. Additionally, home-cooked meals are usually healthier, which can save you money on healthcare in the long term.

8. Embrace Second-Hand Goods

There’s no shame in buying second-hand items, especially if they are still in good condition. Whether it’s clothes, furniture, or electronics, second-hand markets like Owino or Kisekka can offer great deals that will save you a lot of money compared to buying new. Be sure to inspect items carefully to ensure they are of good quality before purchasing.

9. Join a Savings Group

Savings and Credit Cooperative Organizations (SACCOs) or local savings groups are a great way to build up your savings. By pooling money with others, you can benefit from collective savings and even earn dividends at the end of the year. These groups also provide a sense of accountability, which can motivate you to keep saving regularly.

10. Use Public Transport

If you live in a city like Kampala, transport costs can eat into your monthly budget. Opt for public transport, such as taxis or bodabodas, instead of expensive private rides. If you live close to work, walking or cycling is even better for both your health and your wallet. You could also carpool with colleagues to reduce daily commuting costs.

Conclusion

Saving money on a low income in Uganda may require discipline and creativity, but it is achievable. By creating a budget, cutting back on unnecessary expenses, and taking advantage of savings groups and discounts, you can steadily grow your savings over time. Remember, the key to successful saving is consistency, even if the amounts are small. Start with these practical tips, and soon you’ll find yourself on the path to financial security.

Want to learn more about managing your finances?

Explore more tips and tricks on how to save, invest, and grow your wealth on Ugandan Wallet. Start your journey to financial independence today!